What are the Development Trends and Opportunities for China's Short Video Industry?

Chinese short video platform classification

Chinese short video platforms can be broadly categorized into two types: those primarily focused on live streaming and those primarily focused on short video content. Live streaming platforms emphasize real-time interaction and entertainment, while content-driven platforms prioritize social interaction and content sharing, focusing on developing user relationships, fostering engagement, and creating engaging videos.

Short video platforms primarily focused on live streaming are characterized by including live streaming entry points in addition to short video content. Users can share their lives, perform entertainment, or create art in real time, while viewers can interact and send gifts. Representative platforms include Huya Live, Douyin, and Kuaishou.

Short video platforms, primarily featuring short video content, are characterized by their video-centric format. These platforms encompass various types of short videos, such as entertainment, education, and food, allowing users to browse and share content of interest. A representative example is Rednote (Xiaohongshu).

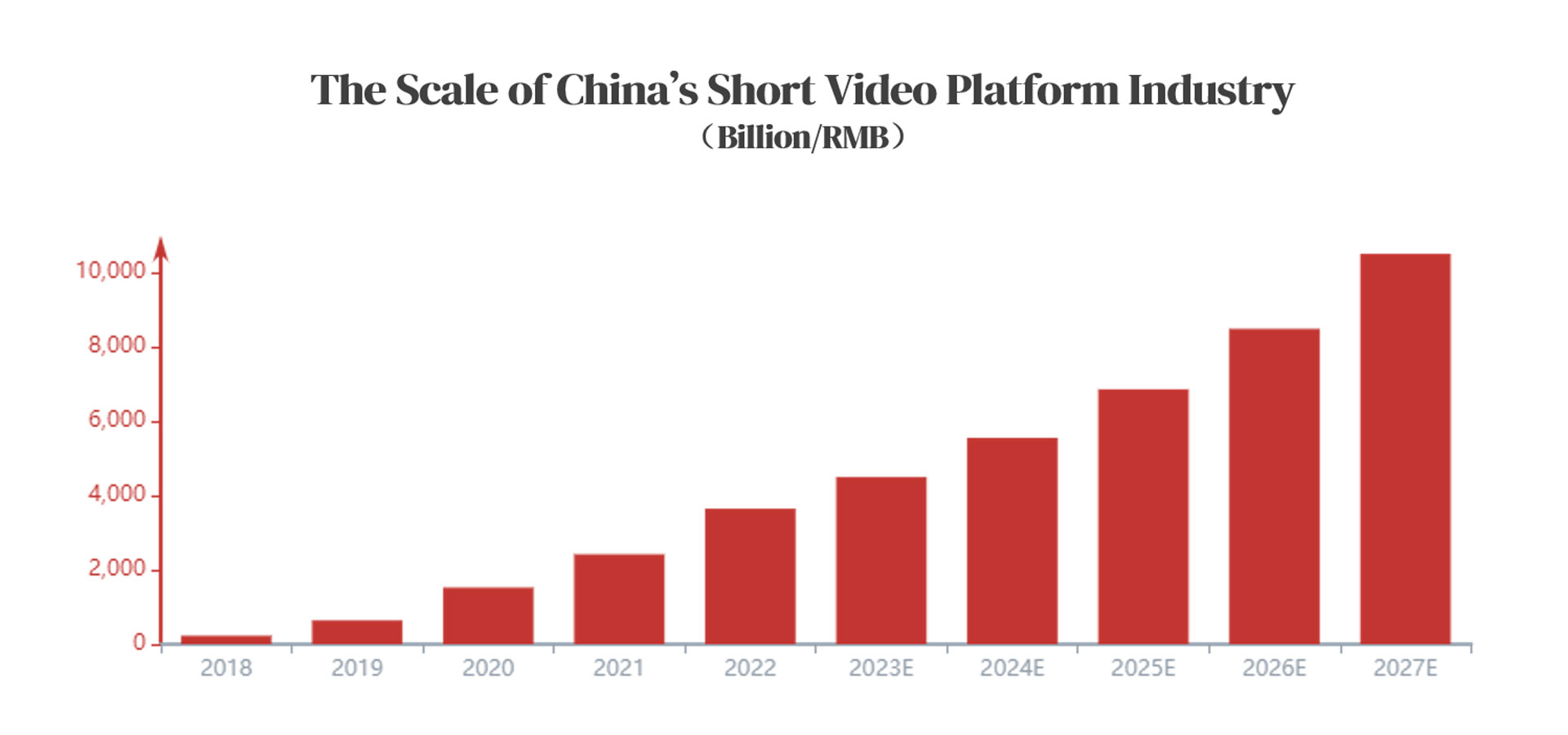

China's short video platform industry scale

The market size of China's short video platform industry has shown a year-on-year growth trend. The revenue of China's short video platforms increased from RMB 22.72 billion in 2018 to RMB 364 billion in 2022, and is expected to reach RMB 1,048.8 billion in 2027, with a compound annual growth rate of 14.5%.

From 2018 to 2022, with the gradual popularization of 5G networks in China and the improvement of users' viewing experience, user stickiness continued to increase, and the market size of short video platforms expanded at a high growth rate. As of December 2022, the number of short video users exceeded 1 billion, with a user penetration rate as high as 94.8%. Major short video platforms in China are constantly enriching their content, improving video quality, and optimizing platform services. For example, Rednote (Xiaohongshu), under Xingyin Technology, is constantly adding new businesses such as live streaming and shopping functions to attract more users.

The market size of China's short video platform industry is projected to maintain growth from 2023 to 2027, but the growth rate will gradually slow down. Due to the already significant scale of live-streaming sales of agricultural products on platforms like Douyin and Kuaishou, the continuous implementation of national policies to help farmers sell agricultural products through e-commerce platforms, and the traffic support provided by these platforms to major e-commerce companies, China's live-streaming e-commerce revenue will continue to maintain a certain growth rate. However, competition in China's short video industry is becoming increasingly fierce, and the market is approaching saturation. The number of mobile short video users in China is expected to reach 1.14 billion by 2025, representing a massive user base.

Characteristics of Chinese short video platforms

Analysis of the Characteristics of China's Short Video Platform Industry: With the popularization of mobile internet and the improvement of network speed, short video platforms have rapidly emerged in the Chinese market. The Chinese short video platform industry is characterized by three main features: diversified profit models, a trend of user segmentation, and the clear advantages of leading companies.

1. Diversified profit model

Diversified Profit Models: Short video platforms primarily utilize revenue models including advertising, live streaming revenue sharing, and live e-commerce. Advertising is a natural way to monetize through social platforms like short videos and live streaming; both user numbers and time spent on these platforms are crucial parameters for advertising monetization. As short videos and live streaming account for an increasingly larger share of total mobile user time, advertisers are placing greater emphasis on these marketing channels. It is projected that by 2025, Chinese mobile internet users will spend 25.1% of their total mobile internet usage time on short videos and live streaming .

In 2022, short videos were the only category to show growth in both media platforms and advertising formats, and the only category to experience growth in 2022. The future development trend of short video advertising is promising. Revenue sharing from live streaming donations is also one of the main ways short video platforms generate revenue. Taking Douyin live streaming as an example, the revenue from fan donations to the streamer is split between the streamer and the platform at a ratio of 4:6 or 5:5, with the short video platform taking a larger share. In addition, short video platforms also increase revenue streams through e-commerce. Meanwhile, due to the increasing prevalence of e-commerce live streaming on short video and live streaming social platforms, the total transaction volume of live streaming e-commerce in China is expected to grow to 6.4172 trillion yuan by 2025, accounting for 23.9% of the total transaction volume of China's retail e-commerce market.

2. Users are showing a trend of differentiation.

Different platforms have different user profile focuses. Short video platforms show a trend towards user segmentation. Taking Douyin and Kuaishou, the two leading short video platforms, as examples, in terms of gender ratio, Douyin users account for 55.4% and female users account for 44.6%, with male users being more numerous. However, the gender ratio of Kuaishou users is not significantly different, with males accounting for 55.8% and females accounting for 44.2%.

In terms of age distribution, 48.5% of Douyin users are under 30 years old, and 25.5% are between 31 and 35 years old, indicating that Douyin's users are mostly young and middle-aged. Kuaishou users are mainly over 31 years old, but there is a trend of radiating to both ends of the age spectrum: 29.6% are between 31 and 35 years old, and 26% are between 24 and 30 years old.

In terms of city distribution, Douyin users are mainly concentrated in new first-tier cities and third-tier cities, with first-tier and new first-tier cities accounting for 35% of users. Kuaishou has a larger proportion of users in lower-tier markets, with third-tier cities accounting for the largest share at 22.2%, while first-tier cities account for the smallest share at only 9.2%.

3. Leading manufacturers have obvious advantages.

The short video platform market is highly competitive, with leading platforms boasting massive user bases and strong user engagement. China's leading short video platforms have large user bases and high user stickiness.

As of October 2022, Douyin had over 800 million monthly active users, with an average daily usage time of 125 minutes per person.

As of the end of 2022, Kuaishou had an average of 640 million monthly active users and 26.7 billion pairs of users who followed each other.

Rednote (Xiaohongshu) has an average of 260 million monthly active users and 20 million monthly active creators.

These three short video platforms hold a dominant position in the industry, leaving less and less room for smaller platforms to survive. Smaller or newer platforms need to continuously improve user experience, enhance the quality of their short video content, update their technology and algorithms, and expand their content ecosystem to increase user engagement and gain a competitive edge.

China's short video platform industry has so far gone through three main stages of development.

1. Germination period 2004~2008

In November 2004, LeTV officially launched, and at the end of the same year, Sohu Video was established (formerly Sohu Broadband). In the first half of 2005, platforms such as Tudou, PPTV, and PPS were launched one after another, becoming the main members of the early development of China's video website group.

In 2006, Sohu Podcast, a video sharing platform under Sohu's portal website, was established. In December 2006, Youku officially launched, leveraging its "speed is king" product philosophy—fast playback, fast publishing, and fast search— to fully meet users' growing interactive needs and diverse video experiences . That same year, Ku6 launched, focusing on UGC (User-Generated Content) development while providing users with diverse choices, covering everything from professional film and television programs to self-produced online dramas.

" micro-videos " emerged. Most of these micro-videos were based on web pages, and at this time, the short video platform industry had not yet formed a complete business model.

2. Start-up period 2009-2015

In 2009, China Network Television (CNTV) was launched. In 2011, Kuaishou was born, initially focusing on the creation of animated GIFs.

In 2012, Kuaishou transformed into a short video platform, and in the same year, Xunlei launched Youliao.

In 2013, short video platforms such as Tencent Weishi and Miaopai were launched one after another, with Miaopai partnering with Weibo to become an embedded application.

In 2014, Rednote (Xiaohongshu) were launched.

During this period, with the continuous development of mobile internet technology, major companies have launched short video platforms, enriching the lineup of short video platforms, and short video platforms have gradually gained popularity and public recognition.

3. Period of rapid development (2016-present)

In 2016, Huoshan Video, Douyin were launched.

In 2017, Tudou transformed into a short video platform, Toutiao launched Xigua Video, Tencent relaunched Weishi, and 360 Video and Baidu Haokan Video were launched.

In 2018, Tencent led multiple rounds of investment in Kuaishou, ByteDance acquired the overseas short video platform Faceu, and iQiyi launched Natto.

In 2020, Huoshan Video and Douyin Short Video were officially integrated and upgraded into Douyin Huoshan Version.

In 2021, Douyin partnered with CCTV's Spring Festival Gala, becoming the exclusive brand partner for interactive red envelope giveaways during the gala .

In 2022, Douyin formed a strategic partnership with a Chinese record company and launched a PC client, which could be downloaded from app stores to obtain a pass.

During this period, a series of short video platforms emerged, leading to fierce competition in the industry. Simultaneously, with the deep integration of live streaming and e-commerce, the short video platform industry gradually formed a unique commercial positioning and development path. Significantly reduced mobile data costs and continuously improving content distribution efficiency spurred a substantial increase in the number of short video users, resulting in a clear traffic dividend. The short video platform industry officially entered a period of rapid development.

Analysis of the Industry Chain of Short Video Platforms in China

The Chinese short video platform industry comprises upstream resource providers, midstream short video platforms, and downstream end users. Upstream resource providers include content and information providers such as top bloggers (KOCs/KOLs), celebrities, and ordinary users in various fields. It also includes marketing service providers, advertising partners, and MCN agencies that provide resources, strategies, and data support for short video distribution. The midstream market is dominated by short video platforms, primarily responsible for providing services such as advertising integration and content delivery, connecting downstream end users with upstream short video providers. The downstream market consists of short video users who receive content pushed by the platform, watch, comment on, share videos, and consume content.

upstream of the industrial chain

Upstream resource providers in the industry chain include content and information providers such as top bloggers (KOCs/KOLs), celebrities, and ordinary users in various fields. They also include marketing service providers, advertising partners, and MCN agencies that provide resources, strategies, and data support for short videos. MCN agencies' business types include content production, account operation, advertising and marketing, and e-commerce. The rise of the influencer economy has attracted more MCN agencies to the market. Due to the low entry barriers and low entry requirements for MCN agencies, coupled with traffic support and capital backing from short video platforms, the number of MCN agencies has exploded, increasing from approximately 160 in 2015 to 34,000 in 2021.

Midstream of the industrial chain

The midstream market players in the industry chain are short video platforms, primarily responsible for providing services such as advertising integration and content delivery, ultimately connecting downstream end-users with upstream short video providers. By the end of 2022, the number of short video users in China exceeded 1 billion, with a user penetration rate as high as 94.8%. ByteDance and Kuaishou are the leading companies in the short video platform industry. By the end of 2022, Kuaishou had an average of 640 million monthly active users and 26.7 billion pairs of users mutually following each other, demonstrating its large user base and strong user stickiness. ByteDance possesses strong traffic monetization capabilities; its e-commerce platform's gross merchandise volume (GMV) reached 1.4 trillion yuan, a year-on-year increase of 76%. Meanwhile, with the continuous enhancement of content planning capabilities by content producers, MCN agencies, and marketing service providers, as well as the increasing professionalization of advertising and marketing, short video platforms have become a major choice for attracting advertisers' marketing spending, thus driving continuous growth in short video platform revenue. It is projected that by 2026, the revenue of the short video marketing industry will exceed 770 billion yuan.

Downstream of the industrial chain

The downstream market participants in the industry chain are short video users. The content covered by short video ads is becoming increasingly diversified, including e-commerce platforms, beauty and personal care products, games, food and beverages, automobiles, maternal and infant products, and cultural tourism. Regarding the content of ads clicked by short video users, 66.7% of users prefer concise ads, and 65.1% prioritize the accuracy and reliability of the product information conveyed in the ads. In terms of factors influencing ad click-through rates, 64.2% of users click on ads based on product interest, and 59.8% click because the ads are engaging. By continuously enriching ad formats and content and improving click-through rates based on user needs and preferences, short video platforms can enhance their ability to monetize traffic.

Competitive Landscape of Short Video Platforms in China

The massive traffic generated by China's short video industry has attracted numerous participants to enter the market. After multiple rounds of market iteration and consolidation, the leading competitors include companies such as ByteDance, Tencent, Alibaba Group, Sina.

Monthly active user scale is one of the key factors attracting advertisers to allocate marketing budgets and thus generating revenue for short video platforms, and ByteDance firmly holds a dominant position in this metric. In 2022, Douyin had an average of 300 million monthly active users and a total of 1.9 billion monthly active users, demonstrating extremely high user stickiness. ByteDance, with Douyin, far surpasses other competitors in the industry in terms of monthly active users.

In terms of the number of short video platforms owned by companies, ByteDance ranks first with six, followed by Tencent, Kuaishou, and Baidu. The remaining companies each have only one short video platform still in operation. Tencent once had 17 short video platforms, but after fierce competition in the industry, few platforms were actually still operating as of 2023. Currently, only WeChat Video Channel and Weishi remain in normal operation. Among them, Video Channel has achieved steady development by relying on WeChat's stable and massive user base, with an average of 800 million monthly active users.

Looking at the download numbers of major short video apps on the Apple App Store, ByteDance's platforms, with a total of 63.24 million downloads, far surpass the platforms of competing companies and firmly occupy the top spot. Xiaohongshu (owned by Xingyin Information) and Kuaishou have similar download numbers, both around 13 million.

Competition in China's short video industry is intensifying. With the rise of leading companies, the gap between them is widening, leaving less room for smaller platforms to survive. Some companies will be forced out of the market, leading to a trend towards monopoly. Smaller or newer platforms aiming to become industry leaders need to continuously improve the quality of their short video content, update their technology and algorithms, and expand their content ecosystem to increase user engagement and improve their overall survival within the industry.

客户留言

First Name*

Last Name*

E-mail*

WhatsApp

Line

WeChat

Country*

Website / Company Name*

What projects are you interested in? (Multiple options available)*

- E-commerce

- Digital Marketing

- SEO & SEM

- Video Production

- Advertising

- Website Design

- Chinese Wikipedia Writing

- Press Release Distribution

- Brand Identity Design

- Rebranding Solutions

- Campaign Activation

- Influencer Marketing

- Company Registration

- Accounting & Tax Filing

- Trademark|Patent|Copyright

- Shop Design & Decoration

- Others

Annual Marketing Budget(USD)*

- <$10,000

- $10,000 - $50,000

- $50,000 - $300,000

- $300,000 - $1,000,000

- $1,000,000 - $5,000,000

- >$5,000,000

Please briefly describe your needs.

- I have read and agree with 《Privacy Policy》